Advertisement

Budget is important to control your expenses to avoid the money runs out. So, by reading budget spreadsheet Dave Ramsey article, you will find beneficial tips for you.

If we talk about money, it will not finish. Money is a crucial thing to expenses or spends it. But, most people can’t manage well. That’s why their money will be gone before the end of the month; you can’t expense as much as in the begin of the month. From that, you must make a budget spreadsheet to control your money better than before. Budget spreadsheet Dave Ramsey article will share useful tips for you.

Contents

Advertisement

Tips for Managing Your Budget Spreadsheet Dave Ramsey

To get the best result of personal finance budget worksheet, you need tips for it. Because you can’t do it by tips. The tips of budget spreadsheet Dave Ramsey will benefit for you in managing the budget. There are some of the useful tips for you.

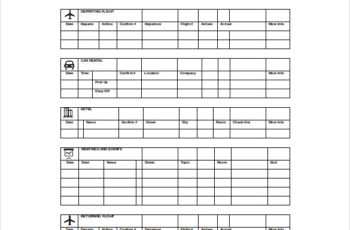

1. How to Make a Budget Spreadsheet

Of course, this is the first step to manage your money. There is some step you have to follow in making a budget spreadsheet Dave Ramsey.

- Write down your total income; your income is not only from monthly salary. It can from your bonus, freelance job and everything jobs that make money will come into your pocket.

- List all your expenses, to make it clear of your expenses. Although your expenses will be different in every month, at least you have known all your expenses.

- Make your income to be zero, your income minus by your expenses should zero.

- Tack your expense every month, at the end of the year; you can compare your outcome. It can evaluate to make good to manage your money.

2. Tips to Practice

Apply the tips in your daily life to get the best result. Without applying, your monthly household budget will not be better.

- Do it together, if you are married do it by your partner. It has been a household responsibility to do it. If you are single, find someone who has accountability in managing your expense.

- Every month will change, means your necessary will be different to spend your money. You will not service your car or smartphone every month. It’s good if you have a bank account to save your funds. When there is a related event, you just go to ATM to make money withdrawal.

- Pay off your debt; it prevents you have many bills you must to pay. Prioritize yourself to pay off your debt. Forget have fun to spend it.

- Say goodbye to a credit card; credit card just makes your bills are piling up. Throw away your credit card and change to debit card will use as an electronic payment.

- Try online budget, use the monthly household budget in Android or iOS to manage your money if you want to fell simple to manage your expenses. You can get it by free download on your smartphone.

3. Tip for Inconsistent Income

For some people who have inconsistent income don’t worry. You can make a budget spreadsheet Dave Ramsey. This is a compulsory thing to keep that your money is in your pocket. Just make a simple budget spreadsheet and put priorities outcome.

Everyone can make a personal finance budget worksheet as an effort to control your budget. Maybe you will not feel the benefit in short-term of managing the expenses by budget spreadsheet Dave Ramsey. But, at least it will save you in extravagant using the money.

Advertisement