Advertisement

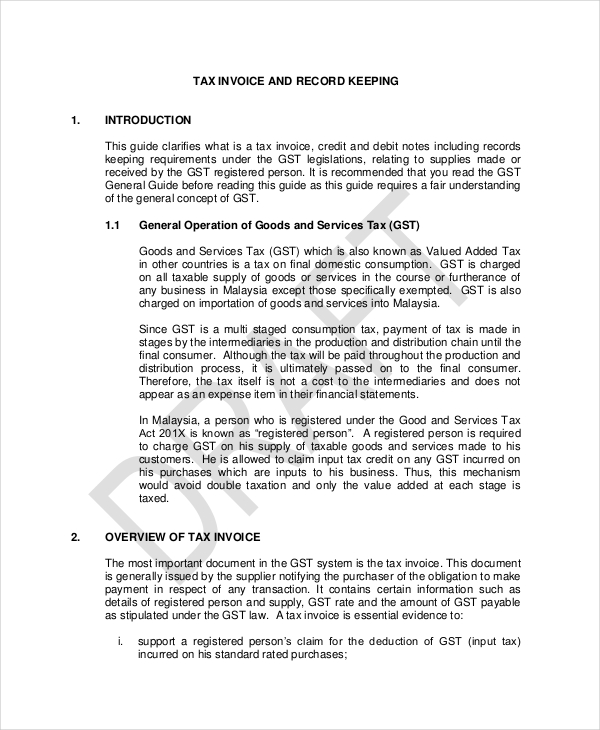

When you are making your invoice template NZ for tax purpose, you need to pay more attention to some important details since your tax invoice needs to be valid. And by valid, this means that your tax invoice has to comply with the requirements as regulated by New Zealand Inland Revenue. Basically, all tax invoice templates you can find out there already include all the required information, although it is never a bad idea to double check.

Contents

What to Include in Your Tax Invoice

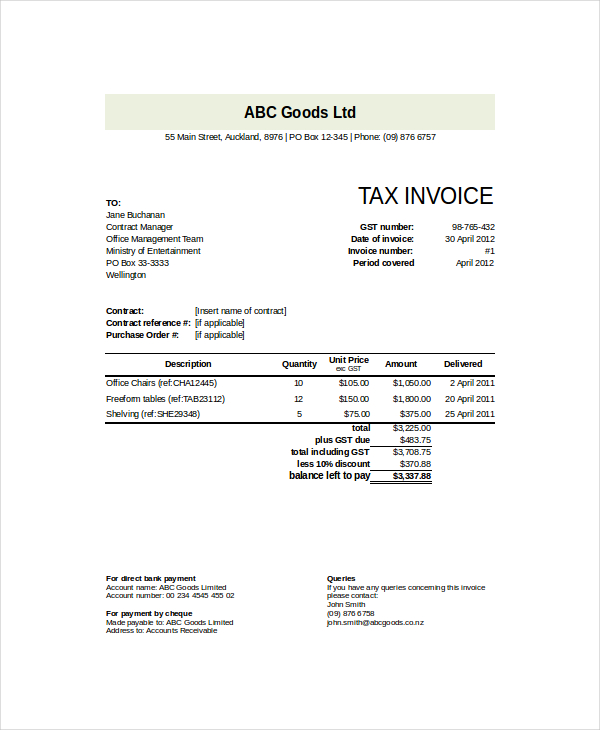

A valid tax invoice, according to New Zealand Inland Revenue, needs to have these information details: the “Tax Invoice” header, the supplier’s name and registration number, the recipient’s name and address, the issuance date of the tax invoice, and the description of the services and goods supplied. Plus, you need to describe the volume or quantity of services and goods supplied along with either the consideration for supply and a statement with the tax charge included, or the total tax amount charged and the consideration inclusive of or excluding tax.

Advertisement

About GST

The legally compliant tax invoice needs to not only meet the requirements as regulated by New Zealand Inland Revenue, but also is capable of GST calculation. GST stands for Goods and Services Tax, referring to the value added tax on most services and goods in New Zealand and most imported items, as well as certain services imported to the country. The tax is added at the rate of 15 percent to the price of services and goods that are taxable.

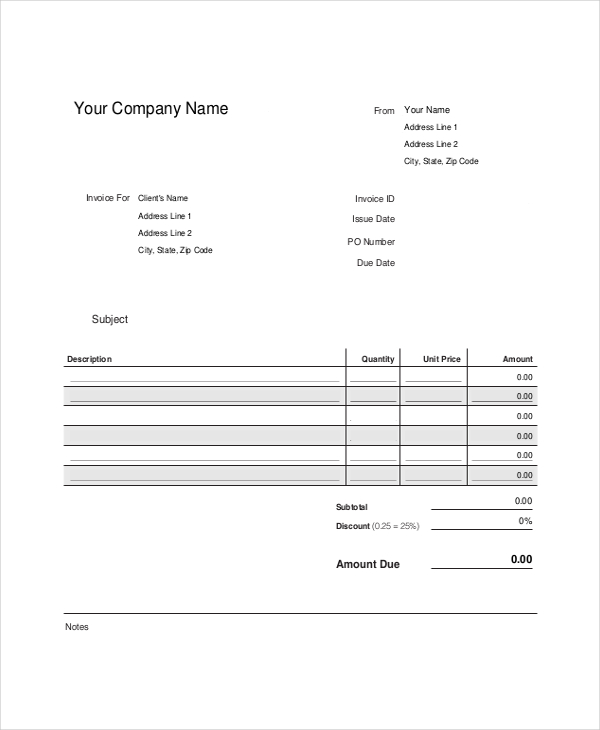

Invoice Template for Excel

Typically, you will find the invoice template NZ in a file format that makes it accessible from Microsoft Excel. Well, without a doubt, this offers so many benefits for your convenience and ease. Compared to invoice template for PDF or Microsoft Word, or even HTML or Photoshop format, the Excel one usually already has the formula to help you calculate. This way, all you need to do to fill in the tax invoice is typing down the base value, such as for Unit and Quantity Price, Hours and Hourly Rate, and Days and Daily Rate. This way, the calculations for totals and taxes can be automatically done. Once you’re finished, you can finally print the invoice for your use.

Again and again, always remember that your tax invoice should always show the GST on the services and goods that have been provided. Apart from that, the invoice needs to use the New Zealand currency and be original. Don’t forget that the GST registered supplier can issue only one original invoice for every taxable supply. Hence, if the purchaser loses the tax invoice, the supplier may still issue a copy which is marked clearly with “copy only”.

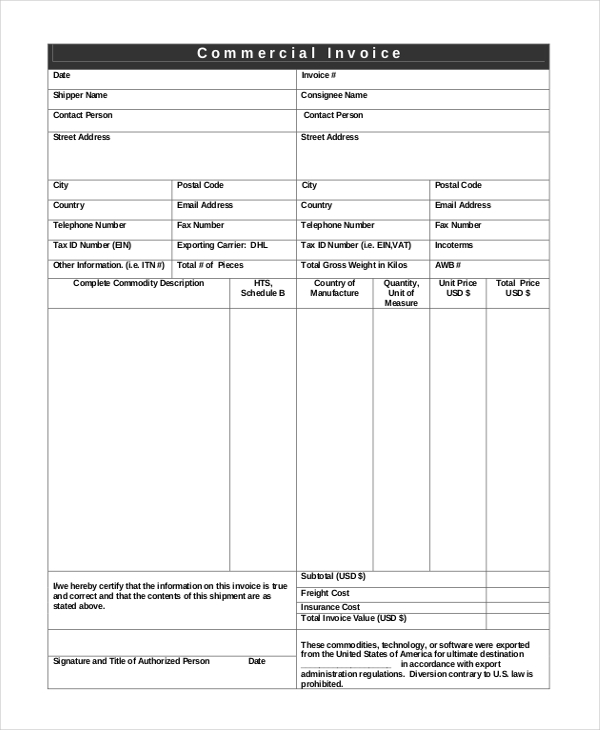

Shipping Invoice Template

commercial invoice template2

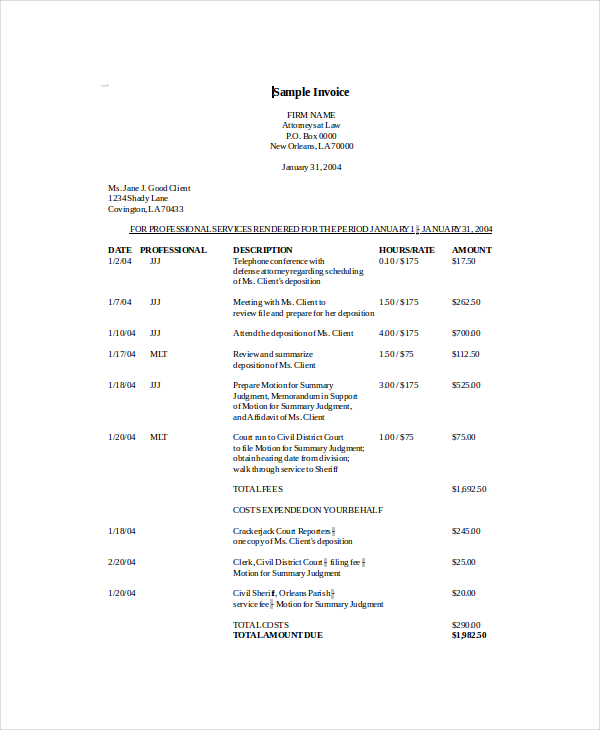

Corporate Invoice Template

Goods Invoice Template

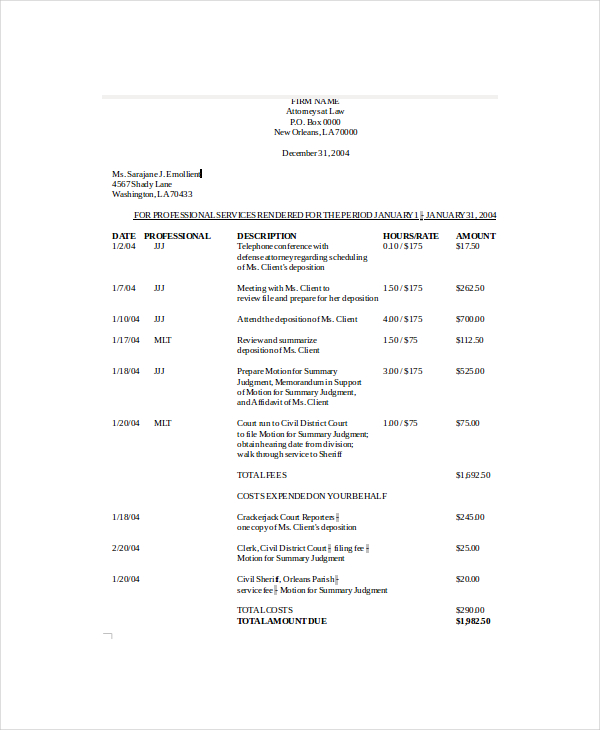

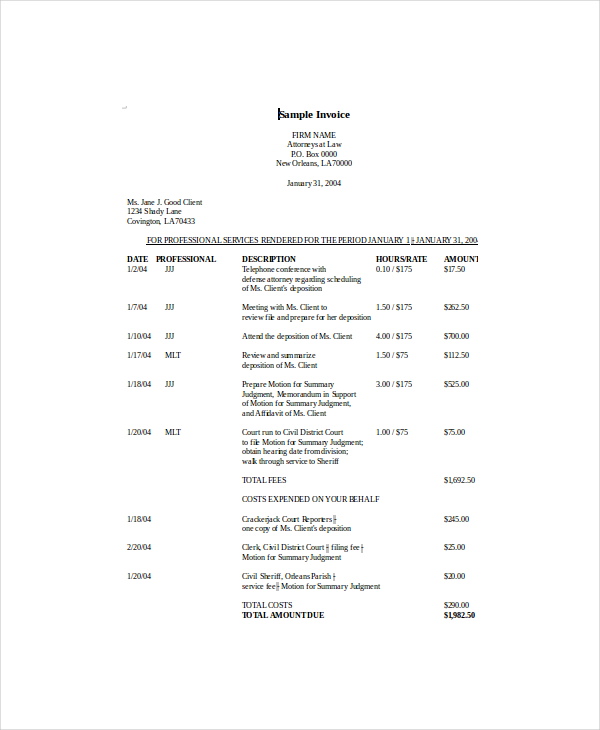

Professional Services Invoice Template2

Professional Tax Invoice Template Example

Proforma Invoice Template

sales invoice template

In general, the invoice template NZ is a good source and guide for you when you are making your own tax invoice. Even so, always keep the requirements for a legally compliant tax invoice, including how it should be formatted and presented. You may also find slight differences between invoices depending on the value of supplies reported on the invoice.

Advertisement