Advertisement

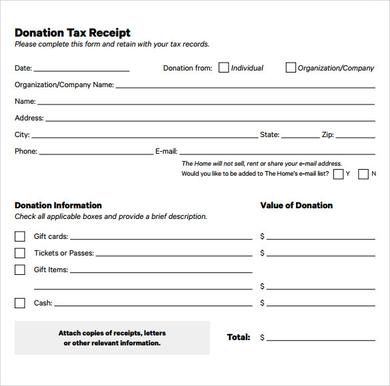

By using the donation receipt template, you thus will have a physical evidence of someone who is paying for charitable causes. As you may have known, it is essential evidence the donor can use to get tax deductions from the government. When an individual donates more than USD 250, he or she has to take the receipt since it is considered as a legal proof of the donor’s name and contact address. Apart from that, the receipt should state if the organization is nonprofit or not.

Contents

E-mail Donation Receipt Template PDF

This donation receipt template is in PDF format which consists of a table featuring two columns. They contain two headers: speech and cursor actions. Name of the donor and organization is mentioned in detail in the table, and it makes a perfect tool for the donor to get tax exemption.

Advertisement

Sample Donation Receipt

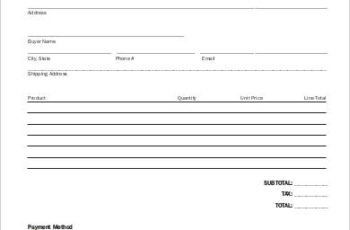

Donation Receipt Template

This is a general donation receipt template that contains the basic information essential to be stated in a proper donation receipt. Typically, this will contain empty fields to be filled in with number, date, information of donor (name, address, and phone number), information of organization or foundation with logo, and details regarding the donation (fund or goods).

When the donation is in a form of goods, the template will already contain at least two separate columns to state the quantity and name of items donated. Meanwhile, if the donor donates fund, the receipt will state the amount of money donated.

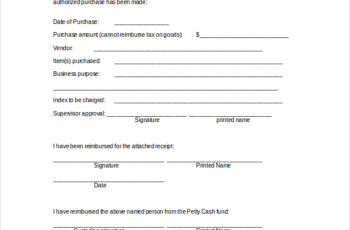

Donation Receipt Form Template

The receipt can be in a form of a receipt too. In general, it states the same information about the donor, organization, and donation in details. What makes it different is its format, which is more like a form than a receipt, although it can be used for the same purpose.

Instead of relying on the receipts created by hand, the online versions offer a better solution. With many different formats to choose from, you can speed up the whole process to fill the required information. Plus, with the receipts, you can thus improve your organization’s finance by claiming the tax rebate from the amount of money donated. Apart from that, with the template, it can facilitates the donation in term of various types of items donated.

By using the donation receipt template, you can easily benefit from the amount of time and money to save. In the end, you no longer need to design the receipt format since it has been available readily on the internet. This way, you can focus on the accuracy of information provided in the receipt template only. With the receipt format structured accordingly, finding out the total of donation, either in form of goods or fund, can be done easier.

In addition to those benefits, using the donation receipt template can also help minimize the effort to keep the donations in track to the institution or organization. Hence, whenever any dispute shall arise, the receipt template makes a handy tool for the parties involved in it.

Non Profit Donation Receipt Template

Non Profit Donation Receipt Template

Tax Deductible Donation Receipt Template

thehome.org

Sample Official Donation Receipt

interconnection.org

Advertisement