Advertisement

The decision to borrow or lend some money, especially in large quantities is not the usual case. To avoid the possibility of misunderstanding between two parties, it should be made a special treatment by making a written agreement. In case of loan agreement, it is a letter that is deliberately created as well as to confirm whether the offer of money given as a loan or a gift. Therefore, loan agreement template is needed that can be used as an appropriate reference.

Contents

Terms

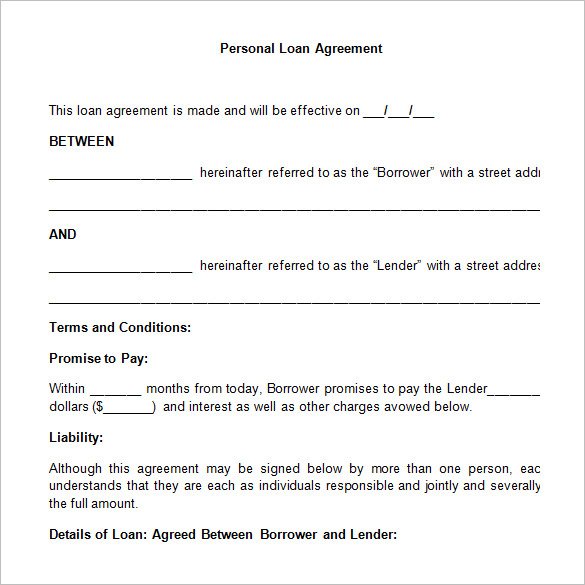

Before starting to make a loan agreement, there are several requirements that must be known by the two parties. First term is you can make a loan agreement if you want to lend money to others by attaching several conditions. Next, you want to borrow money from the private sector. Then, you want to set the table including the amount of interest which is included in the agreement and if you want to determine the amount of the monthly payment on the borrower in accordance with approval by both parties.

Advertisement

Basic Elements in Loan Agreement

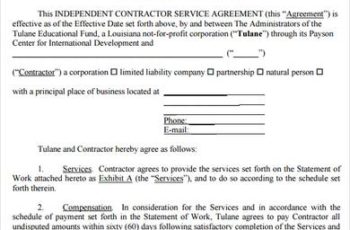

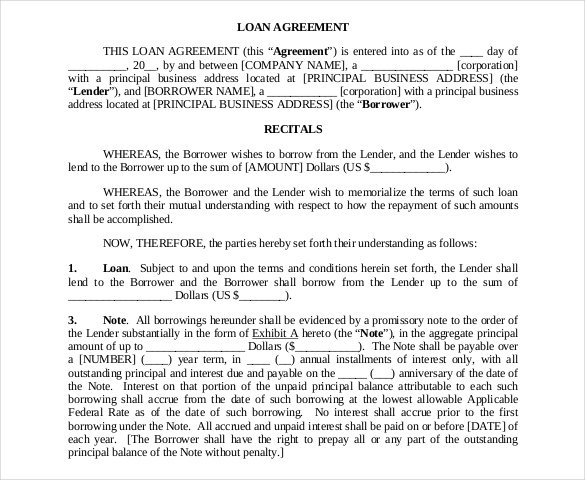

At least in terms of its contents, it must contain several important and fundamental things to make the loan agreement template complete. First, it must declare the borrower and the lender or the person who lend money and the person receiving the money. Second, of course, about the number of loans offered or given must be stated in the agreement. Then, what is called as interest or the amount of money that should be returned include an extra amount as a charge for borrowing. The last is when the money must be returned or granting of returned money period.

Other Details

The lenders usually give some other terms beyond the basic elements. All would have to be approved by the borrower and absolutely it has been through the process of agreement. It usually includes payment plans and options, collateral or guarantees, late fees, credit sale if the borrower goes bankrupt, and consigner if a lender is not convinced by the borrower’s ability to pay. Some possibilities also may occur like amendment, acceleration, governing law, right to transfer, and more can also be included in the agreement.

As it has noted earlier, the agreement must be fair for both parties. The other side could be involved in the making of the agreement template. Both parties can consult with a lawyer to get an appropriate deal. It is because there should be no aggrieved party in the case. Do not forget at the end part of the agreement to add the signature of each party to be more valid because the loan agreement is a decision that involves many people. All should be clear and transparent as possible, also involves a witness if necessary.

Format Loan Contract Template Free

Format Secured Loan Contract Free Template

Basic Auto Loan Contract

Business Loan Contract

Consolidated Loan Contract Format Free Templat

Construction Loan Contract Template Free

Equipment Loan Contract Form

Financing Agreement Contract Template

Free Interest Free Loan Contract Temp

Free Loan Agreement Template

Free Loan Agreement Form

Free Personal Loan Agreement in Word

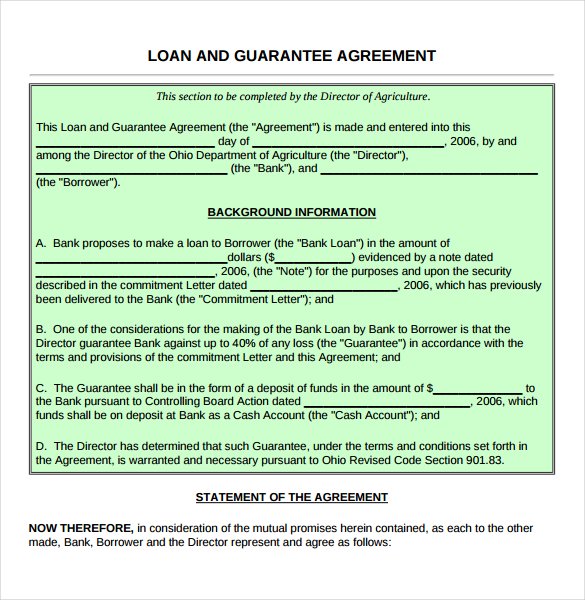

Guarantee Loan Agreement Form Template

Home Loan Contract Template

Loan Agreement Format Free Template

Loan Agreement Template Format Free

Loan Contract Modification Request

Loan Contract Template Format Free

Loan Contract Template free

Money Loan Contract Template Free

Personal Loan Contract Free Template

Sample Loan Agreement Contract Between Two Parties

Sample Loan Agreement Template

Simple Loan Contract Template

Standard Loan Contract Template Free Format

Travel Study Private Loan Agreement Contract

Basically, it is not too difficult to make the template. What you need to do is to know the basics of the loan agreement requirement, understanding when to use the kind of agreement, people who involves in it, and know how to deal with a variety of other possibilities outside the basic elements like amendment, acceleration, governing law, right to transfer, and more that can also be included in the agreement. The loan agreement template and content must be easy to understand and fair for both sides.

Advertisement