Advertisement

Managing money may sound like a truly complicated and boring task, regardless how important it is. Luckily, we can now manage our own finance easier and simpler, thanks to technology and money management tools. Use the budget template you can even get for free, such as the budget template Google that has been inside your Google Drive account already.

Contents

Money Management Templates

The budget template Google can be found inside the Drive Template Gallery—an integrated application inside Google Drive that allows you to access the template gallery right from the “Create” menu. The moment you finally access the “Templates” gallery, finally you can start search for the money management templates to use for your personal purpose.

Advertisement

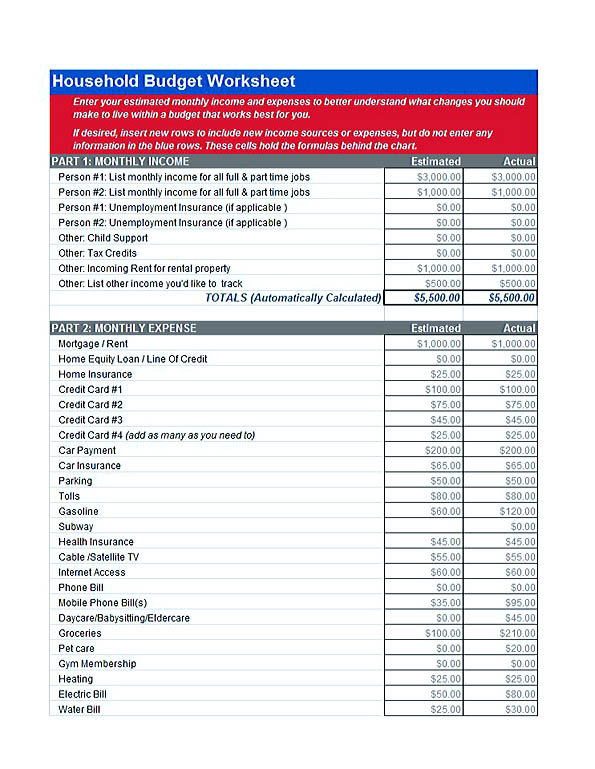

Family Budget Planner

For your household, you can simply use the family budget template Google such as the one designed by ExcelTemplateSource.com. It makes a great first step where you can simply fill in the fields in every section for every month. Simple and easy, this budget planner for family even has a second tab to help you track the income, expenses, and income from your rental property!

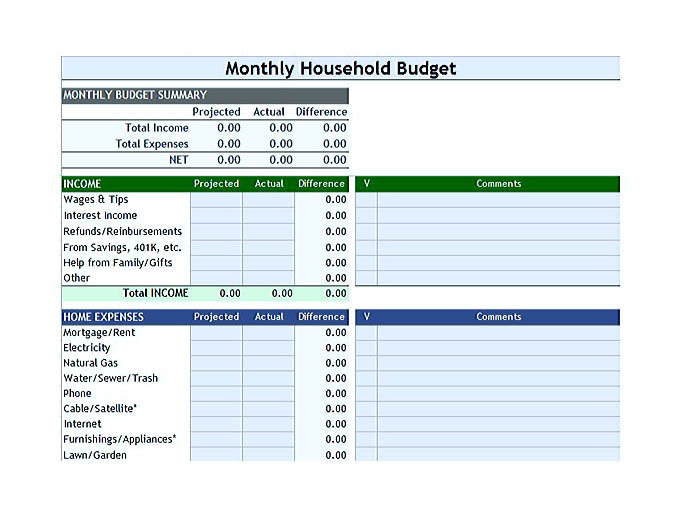

Personal Budget Planner and Tracker

This will help you track all of your expenses and everything in any certain period of time, such as weekly and monthly. The one from Joao Cunha Jeronimo even has a second tab where you can find all the monthly data, which totals are calculated automatically as well. Plus, there are charts for actual tracking numbers compared to the budgeted figures.

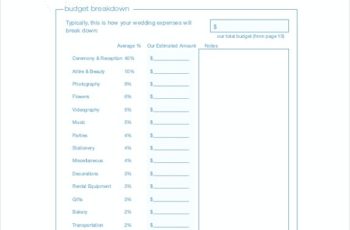

Budget Planners for Specific Purposes

The personal and family budget planners, however, aren’t the only one you can find on Google Drive. You can even find event budget planner template, such as wedding budget planner and vacation budget and trip planner. There are also spreadsheets for budget template Google designed for certain expense, such as vehicle expense sheet where you can, for instance, track how much your vehicle is draining you.

In general, whatever purposes you’re trying to achieve from using the budget planner template, your budget always has to be accurate. Otherwise, it will not work. To make sure your budget works, always make a record of daily spending regarding the budget template you are using. For personal and household purposes, you need to make a list of your annual costs, referring to things you pay for less frequently.

[sociallocker]

https://drive.google.com/a/blueberrylabs.com/previewtemplate?id=0Au43b7KHPfWwdDN6ekJGZHVfVDBHa29fWVd5UWYtX1E&mode=public

https://docs.google.com/spreadsheets/d/1X3ew7pHtWnbtd5AK-Hwm0Vmyfobg6EKWsTkMjGHtmEI/edit#gid=0

https://docs.google.com/spreadsheets/d/1HqImGCIukc9fQCLSI4PjCe1Ji2GnqsJC-Ywz_PF1R4w/edit#gid=0

https://docs.google.com/spreadsheets/d/14yWFbSYuMeSjRN5tVbCfHiphdWYl-p5h_pwT9joKsGE/edit#gid=0

https://docs.google.com/spreadsheets/d/1BWi-SfchERVIzktfWSX3gRECz3MhvVE8t2Bp7fEypgM/edit#gid=0

https://docs.google.com/document/d/1tzDBT4l6HY1G8xlZJVy66q8aaA5bI4UrUJqe70BZYq8/edit#heading=h.gjdgxs

[/sociallocker]

When you are listing your income, it is always recommended to split the money coming into you or your household into separate types, such as wage, miscellaneous income, reimbursement and refunds, interest and dividend, and such. And last but not least, it’s always a good idea to detail the regular saving you already have.

Advertisement